AIG Subsidiary Corebridge to Pay $400M In Special Dividend

American International Group, Inc. AIG subsidiary Corebridge Financial, Inc. CRBG recently announced that its board has approved a special dividend of 62 cents per share. The total consideration for the special dividend is estimated at around $400 million.

Shareholders at the close of business on Jun 16, 2023, will receive the special dividend on Jun 30. It will be given along with Corebridge’s regular quarterly dividend of 23 cents per share. The record date and payment date for the regular dividend are in line with the dates announced for the special dividend.

Corebridge has a dividend yield of 5.4%, higher than the industry average of 3% and its parent company AIG’s 2.4%.

The latest move signifies the financial strength of Corebridge, in which American International is the majority shareholder. As of Mar 31, 2023, AIG held 77.3% of Corebridge’s outstanding common stock. The subsidiary had $365 billion in assets under management and administration at the first-quarter end.

In September 2022, AIG closed the IPO of Corebridge, the holding company for its Life and Retirement business. The aggregate gross proceeds from the offering before deductions to AIG were around $1.7 billion. With this move, AIG has focused more on de-levering and investing in business growth.

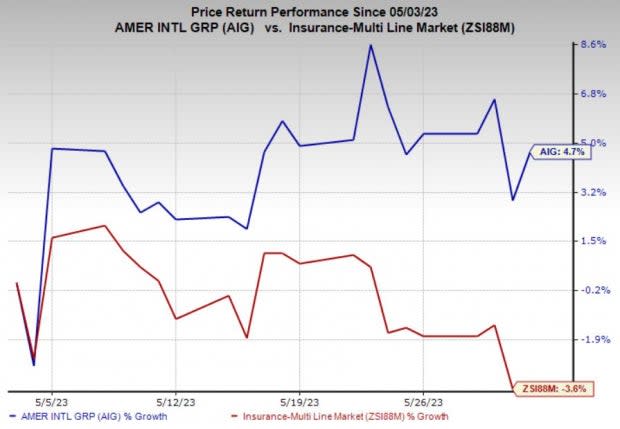

Price Performance

American International shares have gained 4.7% in the past month against the 3.6% fall in the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

AIG currently sports a Zacks Rank #1 (Strong Buy). Some other top-ranked stocks in the broader finance space are Ambac Financial Group, Inc. AMBC and Lemonade, Inc. LMND, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ambac Financial’s 2023 earnings has improved 68% over the past 30 days. During this time, AMBC has witnessed one upward estimate revision against none in the opposite direction.

The Zacks Consensus Estimate for Lemonade’s 2023 earnings suggests 15.9% year-over-year growth. Also, the consensus mark for LMND’s 2023 revenues implies a 53.6% year-over-year surge.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Ambac Financial Group, Inc. (AMBC) : Free Stock Analysis Report

Lemonade, Inc. (LMND) : Free Stock Analysis Report

Corebridge Financial, Inc. (CRBG) : Free Stock Analysis Report